Artificial intelligence is advancing rapidly—perhaps more than most people realize—and its economic impact is already being felt. Speak to anyone in IT, and you’ll hear concerns about job displacement or the urgent need to reskill just to remain employable.

IT giants across the globe are culling their workforce not just to cut costs, but to align with AI-driven efficiencies. Recent examples include Tata Consultancy Services’ record 12,000 layoffs, Microsoft’s AI-focused team reshuffles, and Intel’s downsizing as automation takes over repetitive and technical tasks.

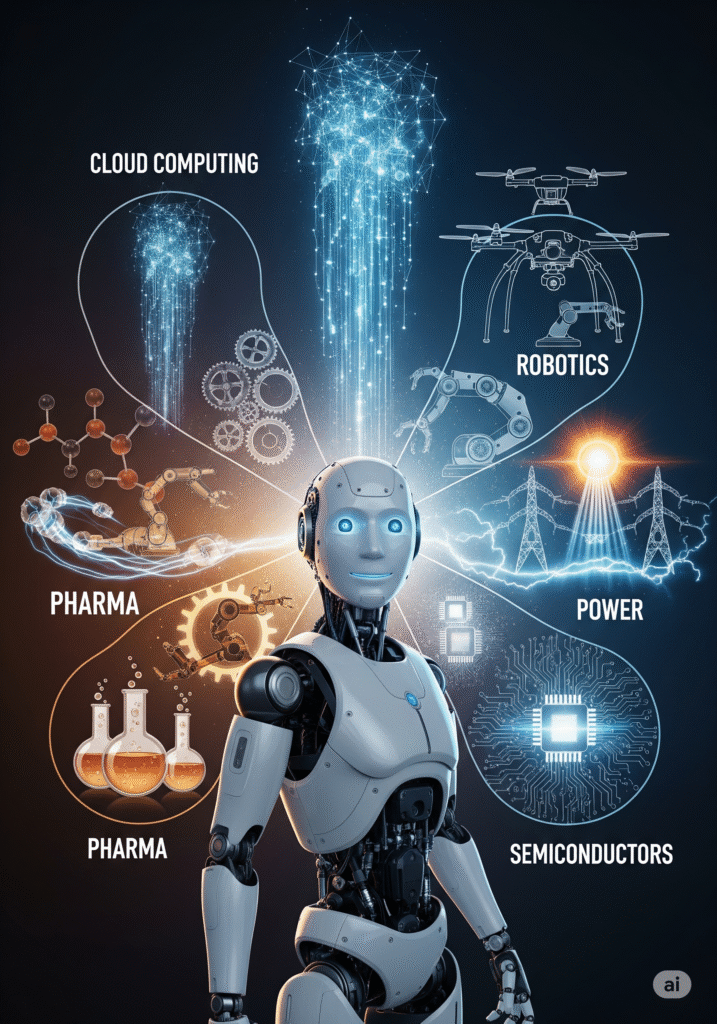

Because of AI, research and development is advancing by leaps and bounds, and entire sectors are either being revolutionized or soon will be in the not-so-distant future.

While such changes create uncertainty for workers, they also signal a deeper economic shift that investors cannot ignore. Entire sectors are being transformed, creating both risk and opportunity. As traditional employment patterns change, there is growing potential in alternate investment avenues—ranging from AI infrastructure companies to robotics manufacturing, data center REITs, and funds targeting automation-driven supply chain efficiencies. This is a watershed moment where strategic allocation over the next decade could yield outsized returns, provided investments are aligned with the sectors AI is set to revolutionize.

“The best way to predict the future is to invest in it today.” — Peter Lynch

“Successful investing is about anticipating the changes that will reshape our world, not just reacting to what’s happened.” — Michael Stevens, Portfolio Manager

Here are a few sectors that warrant close review, as they are likely to be deeply impacted by the boom in AI:

Cloud Computing and AI platforms – Cloud computing and AI platforms form the backbone of the AI ecosystem by providing scalable infrastructure and powerful tools that enable businesses to deploy AI solutions efficiently. Cloud computing platforms like Microsoft Azure, Amazon AWS, Google Cloud, and Oracle provide the essential infrastructure and AI tools businesses need to deploy AI solutions quickly and cost-effectively. Their heavy investment in AI R&D and scalable AI-as-a-Service offerings position them to benefit greatly as AI adoption accelerates across industries.

Semiconductors and Data Centres – With AI’s ability to process vast amounts of data, the demand for high-performance processors will continue to grow in the near future. Companies like NVIDIA and TSMC are far ahead of the curve due to the significant time, resources, and government support required to build capacity and maintain economies of scale. Others such as AMD, Intel, Broadcom, ASML, and SK Hynix are also key players in AI chip manufacturing. In the data centre space, companies like NEXTDC, Equinix, Digital Realty, and Vantage Data Centers are well positioned to benefit from surging storage and processing needs.

Power Companies and Alternate Energy – Data centres consume massive amounts of energy, creating strong demand for power generation and distribution companies. Firms such as Entergy, Southern Company, and Duke Energy are expanding capacity to serve AI infrastructure. In renewable energy, NextEra Energy, Brookfield Renewable Partners, First Solar, and Iberdrola are seeing strong growth, supported by government initiatives worldwide to promote sustainable power sources.

Pharma Research Companies – Industries that require intensive research and traditionally long development phases will now see faster turnaround times thanks to AI. This acceleration can significantly improve return on investment for both companies and their investors. Leading examples include Moderna (AI-driven vaccine and drug development), Recursion Pharmaceuticals (AI-based drug discovery), Exscientia (AI-designed molecules), and BenevolentAI (AI-driven biomedical research).

Robotics – With advances in AI, robots are becoming increasingly intelligent and more human-like. Companies worldwide—especially in labour-intensive sectors—are expected to invest heavily in robots to perform repetitive and time-consuming tasks, aiming for higher returns on investment. Leaders in this space include Boston Dynamics, Fanuc, ABB Robotics, KUKA, and Yaskawa Electric. Consumer-focused companies like iRobot (robotic vacuum cleaners) and Husqvarna (robotic lawn mowers) are also expanding their AI-driven product lines.

The Opportunity

Artificial intelligence is reshaping industries and economies at an unprecedented pace. For investors, this represents a historic opportunity to align portfolios with sectors and companies poised to benefit most from AI innovation. Whether through diversified ETFs, targeted stock picks, or thematic funds, strategic investment in AI-related areas could yield significant returns over the next decade and beyond.

As always, consider your risk tolerance, investment horizon, and seek professional advice when needed to build a portfolio that suits your financial goals while riding the wave of the AI revolution.

Disclaimer:

This article is for informational purposes only and should not be construed as investment advice or a recommendation to buy or sell any securities. Investing involves risks, including the possible loss of principal. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions.

Leave a Reply